Apparel Accounting Software

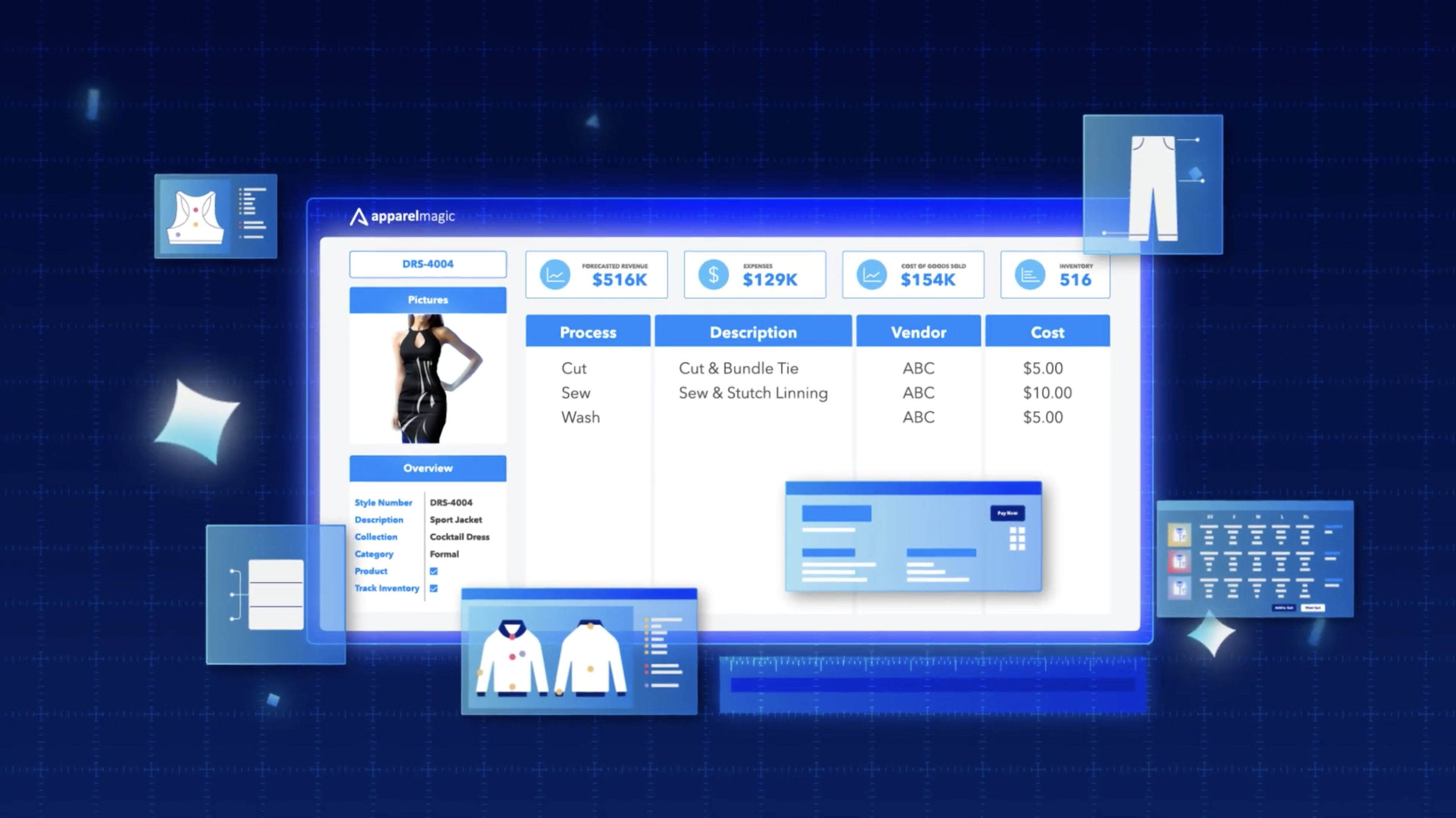

Our integrated apparel accounting software lets you see the big picture so you can compete better! What's more, every ApparelMagic module features clear concise reports. Know your best customers. Understand your top performing styles. Take control of expenses.

Core Reporting

Harness the power of core financial reporting with ApparelMagic, featuring detailed income statements and robust balance sheets for strategic planning.

Expense Tracking

Keep a close eye on your expenditures with ApparelMagic's intuitive expense tracking and optimize your budget management.

Multi-Currency

Expand globally with confidence using ApparelMagic's multi-currency support, managing international transactions with ease.

Sales Reports

Analyze your sales performance and understand customer trends with ApparelMagic's detailed sales reports.

Global Reach

Multi-Currency Accounting

Because the world is your marketplace, ApparelMagic lets you buy and sell in the currencies of your choice. Run multiple sales channels and divisions. Generate income statements and balance sheets. Process credit cards online. You can even send invoices and bills directly to QuickBooks Online and Xero.

Full Transparency

Instant Business Data

With ApparelMagic, you're never more than a couple of clicks away from the most powerful reporting and accounting tools in the game. Pull up relevant data in seconds so you can always use the best, latest numbers when it comes time to make decisions.

Display Preferences

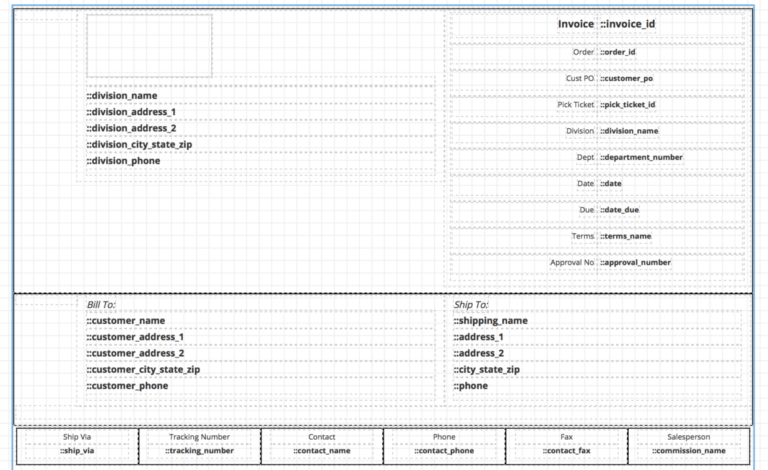

Custom Layouts

Data is in the eye of the beholder. That's why ApparelMagic makes it easy to customize report and transaction layouts to show your data your way.

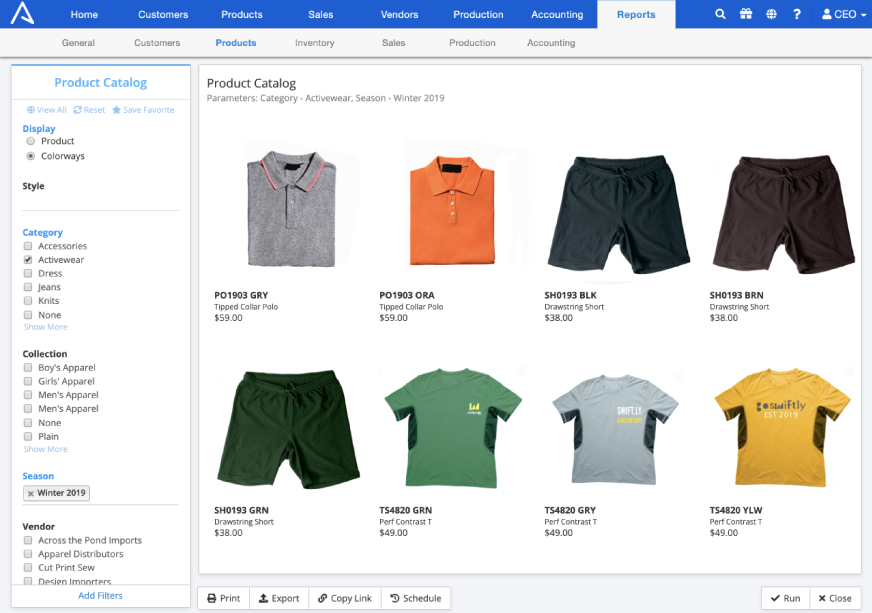

Product Reports

Beautiful Line Sheets

Save time when you view, print, and share full color catalogs and line sheets with your colleagues and customers directly from within ApparelMagic. Use links to share catalogs for always up-to-date assortments, or schedule them to be emailed to you and your team at regular intervals.

Watch

Take a closer look

Learn more about how ApparelMagic's powerful features will run your business with more speed and precision than ever.

Bank Sync

Automate your reconciliation process with ApparelMagic's seamless bank sync, ensuring accurate and up-to-date financial records.

Cash Flow Analysis

Monitor and predict your cash flow with ApparelMagic's analytical tools to make proactive financial decisions.

Accounts Receivable & Payable

Efficiently manage your receivables and payables with ApparelMagic's organized financial tracking.

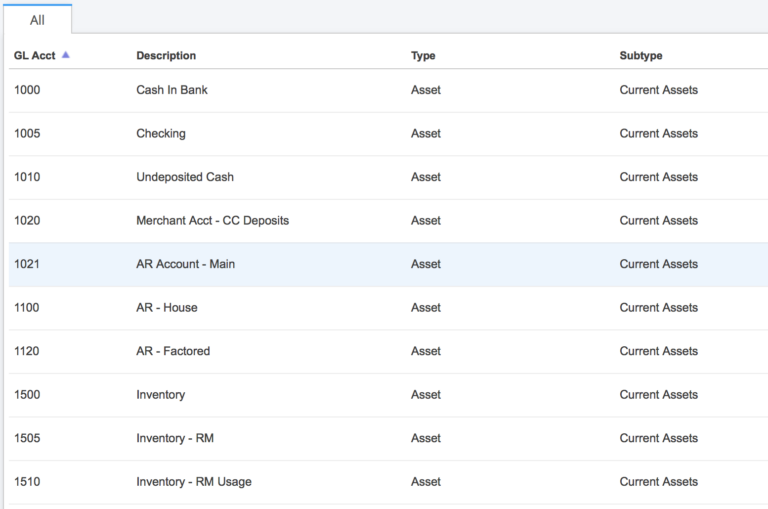

General Ledger

Maintain an accurate record of all financial transactions with ApparelMagic's comprehensive general ledger.

Divisional Accounting

Simplify your finances across different business segments with ApparelMagic's divisional accounting, enabling detailed tracking and analysis for each branch.

“

"Above and beyond satisfied! Support always goes above and beyond the norm to help me!! Thank you!!"

Mell Proffitt

Prodoh

View Pricing →

Discover our competitive pricing plans tailored to fit your business needs.

About the Company →

Learn about our journey to becoming the leading provider of fashion and apparel management software.

Ready to get started?

Sign up now or contact us for a free demo