Determining the worth of unsold stock is a common task for retail businesses. The retail method of inventory (retail inventory method or RIM) is one way to simplify this procedure. This method can help you estimate how much your inventory is worth at the end of a specified period. When combined with physical inventory counting, this strategy will show you how to manage inventory in retail stores.

The retail method of inventory is explained in this article, along with steps to calculate it, tips on when to implement it, and more.

Photo by Jacques Dillies on Unsplash

What is the Retail Inventory Method?

A retailer or retail inventory manager will use the retail method of inventory to evaluate the final inventory balances. The retail method of inventory is an approach that assesses the value of a store’s stock over a specified reporting period. Calculating the ending inventory balance of a store requires using the cost of products, sales, and retail prices. The value of your stock that’s still available for sale at the end of the reporting period is referred to as ending inventory. Because the method isn’t completely precise, it should be supplemented with a physical inventory counting on a regular basis.

Follow these steps to calculate the cost of ending inventory using the retail method of inventory technique.

- Calculate the cost-to-retail ratio (cost of merchandise / retail price of the merchandise) x 100

- Calculate the cost of stock available for sale (cost of beginning inventory + cost of purchases)

- Calculate the cost of sales during the specified period (sales during the specified period x cost-to-retail percentage).

- Calculate ending inventory (cost of merchandise available for sale – sales during the specified period).

Retail Method Advantages And Disadvantages

The simplicity of the retail method of inventory is its key advantage. It’s a simple formula that can help you figure out how much inventory you have. This can then be used to guide your purchase and budgetary decisions.

Another advantage of RIM is that it offers a more streamlined process. Physical checks and counts of inventory can be costly and time-consuming, but this method allows you to do them less regularly because you have an estimate of your stock and its value. There is also no need for a physical inventory when using RIM. Multi-location companies can easily estimate the value of their stock without physically inspecting what they have on hand.

You can also use RIM to create inventory value reports. The retail method of inventory is permissible under Generally Accepted Accounting Principles (GAAP), so you can use it for the purposes of tax reporting. Inventory value reports can also help you figure out how much your company is worth.

However, it should be noted that RIM is merely an estimate, and it isn’t always an exact depiction of how much stock you actually have. Furthermore, for merchants with inconsistent cost-to-retail ratios, the retail method of inventory doesn’t work well.

Who Should Use RIM

There are many types of businesses and business owners that can benefit from using RIM to calculate their ending inventory, including the following:

- Retailers who store inventory in warehouses. The cost of products held in warehouses is relatively steady, unlike retail outlets, where the cost-to-retail ratio is more unpredictable (due to sales/price cuts), hence the formula for the RIM approach will produce more accurate results.

- Retailers with multiple locations who need a picture of their inventory will benefit from this method. Coordinating stock calculations and counts across multiple locations can be tough. RIM could be an excellent way to go if you need to rapidly estimate how much stock you have.

- Wholesalers who sell similar things in huge quantities. If you sell significant amounts of inventory to other stores and all of your items have the same or similar markups, the retail method of inventory is an excellent approach to cut down on physical inventory counts.

- Retailers who don’t hold many sales. If you run a retail business with few to no sales promotions, RIM is an excellent choice because you don’t have to worry about discrepancies caused by irregular markups.

- Retailers who keep their markups consistent. As mentioned before, the retail method of inventory is best for companies that offer products with a consistent cost-to-retail ratio. RIM is a suitable calculation to do if you’re a specialty store that buys products at similar prices and applies the same markup to most or all of your products. However, if you have a wide range of different products with widely disparate markups, you’re unlikely to gain anything from this strategy.

Photo by CHUTTERSNAP on Unsplash

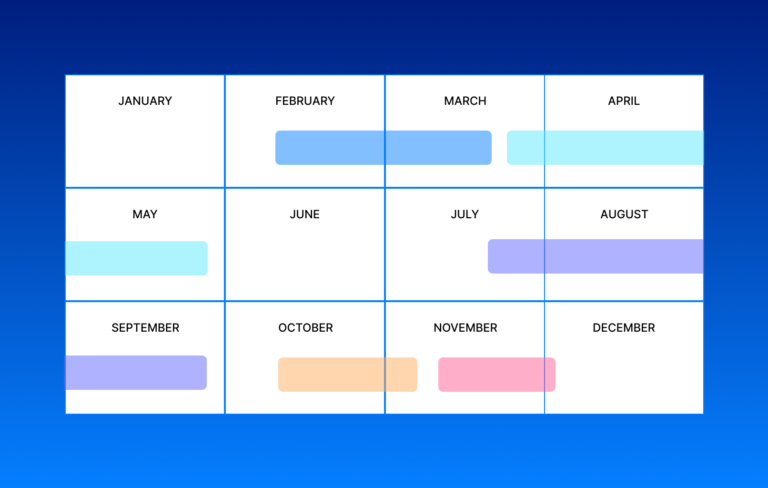

When to Implement RIM

When you implement this method will depend on your accounting, purchasing, and other schedules. One of the situations when this method is beneficial is when you need a rough estimate of the value of your stock. It’s vital to keep in mind that the retail method of inventory only provides estimates, not concrete data. These figures provided by RIM are only estimates because certain items at a retail store or warehouse are likely to have been broken, misplaced, or even shoplifted at some point, which will not be properly accounted for by this method.

In addition, this method should only be used in instances where there is a known relationship between the price at which inventory is purchased and the price at which it is sold to consumers. For instance, if a shoe brand consistently marks up every pair of shoes at 100% of the wholesale price, the retail inventory method can be applied correctly.

On the other hand, using RIM is not recommended if your markups are variable. For instance, if you run sales on specific products, your cost-to-retail ratio will be inconsistent, and the formula won’t provide you with an accurate picture of your stock.

Retail Inventory Method Additional Tips

If you’re planning to employ RIM, keep in mind that it should be used as a part of a bigger inventory management strategy. The approach will be most effective if you combine it with tools like a robust retail management system and barcode scanning software for easy inventory reconciliation.

In addition, you should ensure that you always have the right data. The retail method of inventory approach necessitates the gathering of certain data, such as your beginning inventory, cost-to-retail ratio, and sales, so you must have the most accurate numbers in order to make sure that the calculation is correct.

Finally, physical inventory counts should not be abandoned. The retail inventory technique is essentially an estimate of your ending inventory value, as we’ve already stated. As a result, you should make physical inventory counting a priority. A complete count of inventory will almost certainly necessitate closing your store or counting items outside of business hours. If this isn’t possible, consider using cycle counting, a strategy in which specific, defined inventory portions are counted on a rotating schedule.

The Bottom Line

Keeping track of inventory is a crucial part of running a successful apparel business. It enables retailers to better analyze sales, manage inventory costs, decide whether to order more inventory, and lets them know how much of their goods makes it into the hands of customers rather than being damaged or stolen.

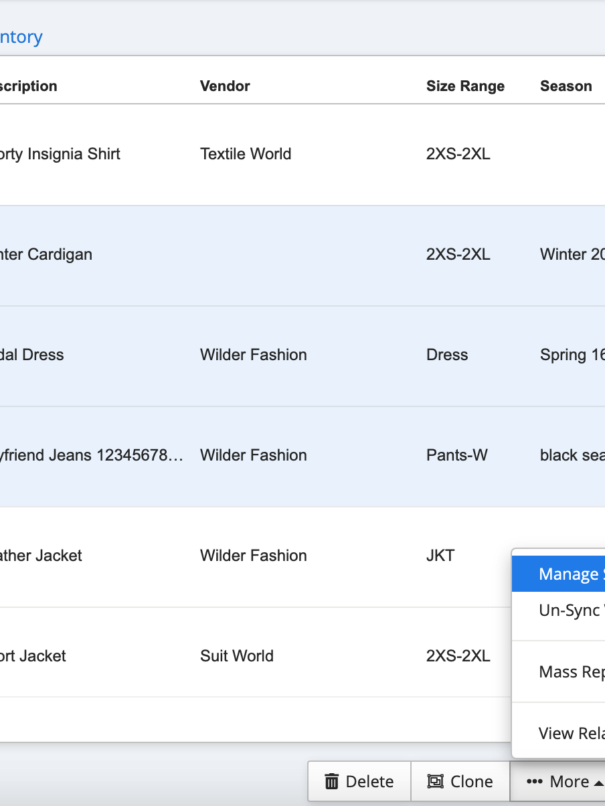

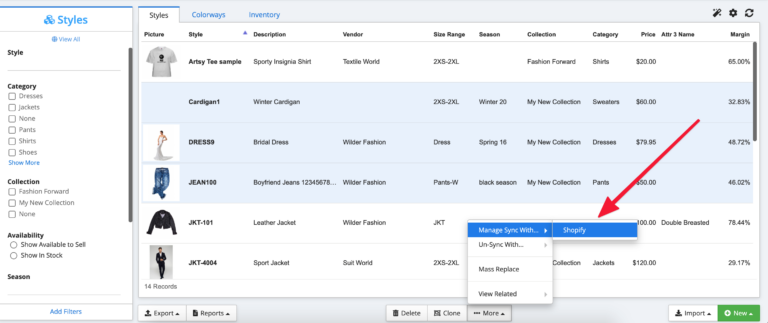

Although the retail method of inventory saves time and money, it is not without flaws. It works best when used as part of a bigger inventory management plan, in combination with other approaches such as robust inventory management software like ApparelMagic, performing physical inventory counts, and regularly reviewing your stock and sales performance.

ApparelMagic allows you to automate all of your inventory management operations. With detailed data and features like real-time metrics, and sales processing, the software allows you to keep track of what is selling and what isn’t, enabling you to foresee trends, make smart purchasing decisions, and keep your shelves filled with goods that are in demand.