Mastering garment costing in fashion is key to maintaining healthy profit margins and ensuring long-term success.

This guide covers the fundamentals of Cost of Goods Sold (COGS), how it differs from general inventory costs, and the best practices for calculating and managing these expenses—integrated seamlessly with tools like ApparelMagic for streamlined operations.

What Is COGS and Why Does It Matter?

COGS represents the direct costs tied to producing the goods sold by a company. This includes expenses such as materials and labor directly involved in production. ApparelMagic supports fashion businesses by simplifying COGS tracking, making it easy to record and calculate production expenses. Understanding and accurately calculating COGS is crucial for setting profitable price points, analyzing gross profit, and crafting effective financial strategies.

Is COGS Recognized When the Service Is Performed?

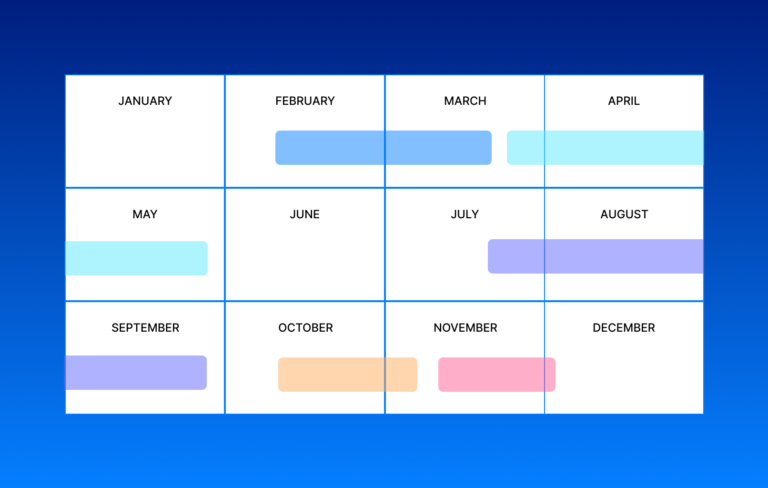

COGS is typically recognized when the product is sold, not when a service is performed. ApparelMagic ensures that COGS is posted accurately at the time of invoicing and sale, providing real-time financial insights that align with business operations.

Cost of Goods vs. Cost of Goods Sold (COGS)

While “cost of goods” and “cost of goods sold” may sound similar, they play distinct roles in financial management:

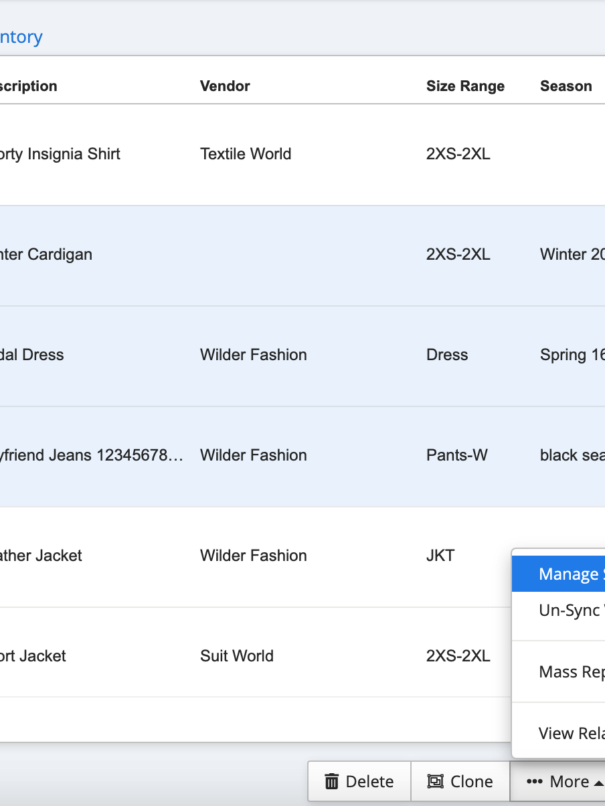

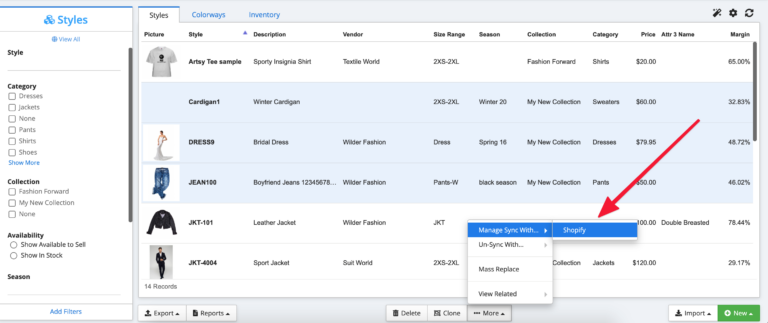

- Cost of Goods: This refers to the total costs associated with acquiring or producing inventory, including purchase expenses, shipping, handling fees, and duties. ApparelMagic’s robust inventory management functionality helps businesses track and categorize these costs effectively, keeping them organized on the balance sheet as assets.

- Cost of Goods Sold (COGS): This reflects the cost of inventory sold within a specific period. Accurate reporting of COGS, facilitated by ApparelMagic, helps businesses analyze gross margins and make informed pricing and inventory management decisions.

COGS Equation

The basic formula for calculating COGS is:

COGS = Beginning Inventory + Purchases during the period − Ending Inventory

ApparelMagic streamlines the calculation process, providing businesses with tools that automate the tracking of beginning and ending inventory as well as purchases, ensuring up-to-date and precise COGS reporting.

How Do You Calculate COGS?

Different methods, such as the weighted average cost method (WAC), FIFO (First In, First Out), and LIFO (Last In, First Out), are used to calculate COGS.

Tracking and Calculating COGS

Accurate COGS tracking requires strategic methods that factor in production variances:

- Weighted Historical Average Cost (WAC): This method averages costs over time and is efficiently managed within ApparelMagic to smooth cost fluctuations and support businesses with varied inventory purchases.

- Actualization: This approach compares estimated landed costs to actual received costs per purchase order (PO). ApparelMagic’s capabilities include tracking these costs to ensure the financial data is current and accurate.

- Timing of COGS Postings: In ApparelMagic, COGS is posted when items are invoiced, accurately reflecting sales activities and ensuring proper financial alignment.

Which Part of the Financial Statement Is COGS?

COGS is listed on the income statement, subtracted from total sales to determine gross profit. With ApparelMagic’s financial reporting tools, businesses can gain a comprehensive understanding of where COGS fits within their statements, allowing for improved pricing and cost control.

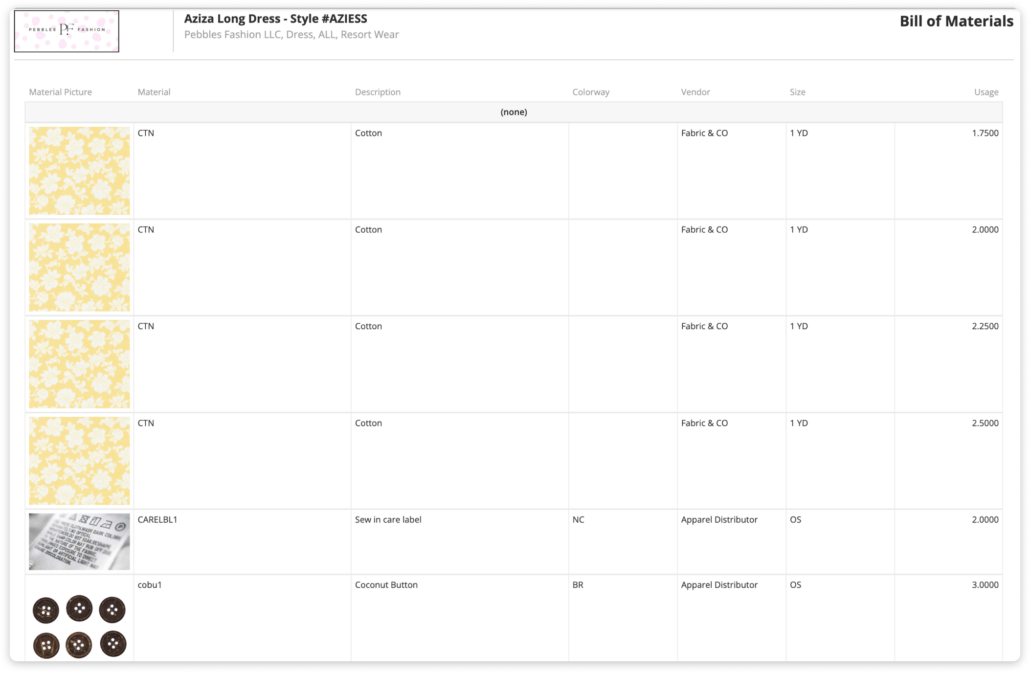

BOMs and Processes vs. Manual Landed Cost

ApparelMagic supports both Bill of Materials (BOMs) and manual landed cost approaches, giving businesses flexibility:

- BOMs and Processes:

- Detailed Costing: ApparelMagic’s BOM functionality offers precise cost allocation for each component and production step.

- Complex Products: ApparelMagic is ideal for businesses with intricate production processes, ensuring materials and labor costs are meticulously tracked.

- Manual Landed Cost:

- Simplicity: For simpler operations, ApparelMagic supports straightforward data management and manual input of landed costs.

- Fixed Cost Structure: Suitable for businesses with stable production expenses.

Key Reports for Analyzing COGS

ApparelMagic provides a suite of reports that support in-depth COGS analysis:

- Gross Profit Analysis: Review profit margins at the item level.

- Sales and COGS Overview: Combine sales data and COGS for a full financial picture.

- Inventory Cost Management: Monitor inventory levels and cost trends over time.

Conclusion

Understanding and managing COGS is vital for optimizing profitability. ApparelMagic empowers businesses with the tools to accurately track costs, whether through detailed BOMs or simpler approaches, supporting robust financial strategies and long-term success.

Take control of your COGS strategy with ApparelMagic’s integrated solutions to streamline your financial processes and strengthen your business’s foundation.